Optimize Your E-commerce Calculations with Zip2Tax Sales & Use Tax Rates.

Optimize Your E-commerce Calculations with Zip2Tax Sales & Use Tax Rates.

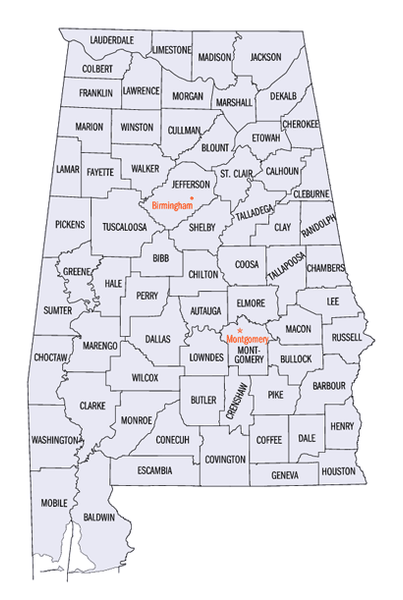

Alabama Sales and Use tax

Choose a State from the List

- Alabama

- Alaska

- Arizona

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Hawaii

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Kentucky

- Louisiana

- Maine

- Maryland

- Massachusetts

- Montana

- Michigan

- Minnesota

- Mississippi

- Missouri

- Nebraska

- Nevada

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Ohio

- Oklahoma

- Oregon

- Pennsylvania

- Rhode Island

- South Carolina

- South Dakota

- Tennessee

- Texas

- Utah

- Vermont

- Virginia

- Washington

- Wisconsin

- Wyoming

The Alabama sales tax rate is currently 4%.

Each county, city and special district can add sales taxes on top of the state rate.

Taxes in Alabama are destination-based, meaning the Alabama sales tax rate is based, or determined from, the destination location an item is shipped to. This complicates business for retailers who need to have the exact and up-to-date sales tax rate for every shipment they make.

To see a full breakout of Alabama sales tax rates by state, county, city and special district, use our easy Sales Tax Online Lookup Solution. After entering a ZIP code, you can enter a retail price to calculate Alabama sales tax totals.

See all the Zip2Tax solutions available for Alabama sales taxes here.

Special Rules for Alabama taxes:

- Shipping is not taxable if separately stated and other specific terms are met.

- Finance charges are exempt from sales tax, when stated separately.

- Clothing is taxed at the same rate as the general sales tax.

- Alabama Sales tax holidays are held for Energy Star items as well as some back to school items and hurricane preparedness items.

Follow this link for more information and details regarding Alabama Sales and Use Tax.