Optimize Your E-commerce Calculations with Zip2Tax Sales & Use Tax Rates.

Optimize Your E-commerce Calculations with Zip2Tax Sales & Use Tax Rates.

Optimize Your E-commerce Calculations with Zip2Tax Sales & Use Tax Rates.

Optimize Your E-commerce Calculations with Zip2Tax Sales & Use Tax Rates.

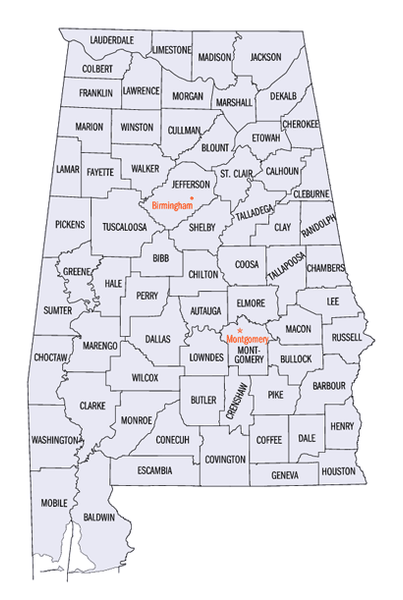

Each county, city and special district can add sales taxes on top of the state rate.

Taxes in Alabama are destination-based, meaning the Alabama sales tax rate is based, or determined from, the destination location an item is shipped to. This complicates business for retailers who need to have the exact and up-to-date sales tax rate for every shipment they make.

To see a full breakout of Alabama sales tax rates by state, county, city and special district, use our easy Sales Tax Online Lookup Solution. After entering a ZIP code, you can enter a retail price to calculate Alabama sales tax totals.

See all the Zip2Tax solutions available for Alabama sales taxes here.

Special Rules for Alabama taxes:

Follow this link for more information and details regarding Alabama Sales and Use Tax.

Zip2Tax provides reliable sales and use tax solutions tailored to meet your needs. Whether you’re managing tax compliance for a small business or handling large-scale operations, our tools simplify the process of calculating accurate tax rates across jurisdictions. For businesses seeking advanced tools, explore our Sales & Use Tax Rate API for seamless integration or use our Sales & Use Tax Online Lookup to quickly access the rates you need.